When deciding whether to rollover a retirement account, you must meticulously take into account your own scenario and Tastes. Info furnished by Beagle is only for common applications and is not meant to exchange any individualized recommendations so that you can abide by a particular recommendation.

Beagle can show you the entire hidden costs which can be robbing your retirement of A large number of bucks.

Set merely, when you’re looking for a tax economical way to construct a portfolio that’s additional personalized towards your interests and know-how, an SDIRA could be the answer.

Moving resources from a person variety of account to a different style of account, including transferring money from a 401(k) to a conventional IRA.

The primary SDIRA regulations from your IRS that buyers need to be aware of are investment restrictions, disqualified individuals, and prohibited transactions. Account holders will have to abide by SDIRA regulations and polices as a way to protect the tax-advantaged status of their account.

Complexity and Duty: By having an SDIRA, you have far more Regulate above your investments, but In addition, you bear a lot more obligation.

Be accountable for how you grow your retirement portfolio by utilizing your specialised knowledge and passions to speculate in assets that in shape along with your values. Got skills in real-estate or non-public fairness? Utilize it to support your retirement planning.

This features comprehension IRS polices, controlling investments, and avoiding prohibited transactions that can disqualify your IRA. An absence of data could lead to high priced errors.

We demonstrate the distinctions involving two of the commonest varieties of lifetime insurance coverage to help you choose what could be ideal for you.

Homework: It is identified as "self-directed" for your cause. By having an SDIRA, you happen to be entirely responsible for carefully exploring and vetting investments.

Buyer Assistance: Try to look for a supplier that gives dedicated assistance, such as use of educated specialists who can response questions about compliance and IRS guidelines.

The knowledge contained on this Internet site is not supposed as, and shall not be recognized or construed as, tax information. It's not a substitute for internet tax suggestions from an experienced.

All investments have chance, and no investment strategy can promise a profit or defend from lack of cash.

At Beagle, we were Uninterested in how hard it was to keep an eye on our outdated 401(k) accounts. We hardly ever understood wherever all of them were, when they have been building revenue or what service fees we had been shelling out. That’s why we created the simplest way to find your important link entire 401(k)s.

Even though there are several Advantages related to an SDIRA, it’s not without the need of its possess disadvantages. Some of the frequent explanations why traders don’t decide on SDIRAs include things like:

Opening an SDIRA can give you access to investments Usually unavailable by way of a financial institution or brokerage company. Listed here’s how to begin:

Increased Costs: SDIRAs generally feature increased administrative charges compared to other IRAs, as certain aspects of the executive approach cannot be automatic.

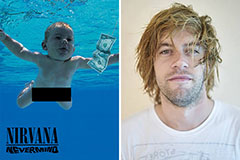

Spencer Elden Then & Now!

Spencer Elden Then & Now! Karyn Parsons Then & Now!

Karyn Parsons Then & Now! Meadow Walker Then & Now!

Meadow Walker Then & Now! Nadia Bjorlin Then & Now!

Nadia Bjorlin Then & Now! Robin McGraw Then & Now!

Robin McGraw Then & Now!